Contact us

Our team would love to hear from you.

Over the past 20 years, the world has witnessed a boom in solutions for businesses. Advanced technologies have revolutionized the industry, enabling new entrants to compete with established players by offering innovative services that are more convenient and accessible to customers. Read on to learn what moves business leaders should make to stay competitive in the financial market of the future.

Digitalization is evolving rapidly, disrupting the traditional financial services industry. Keep your competitive edge by following these tips.

The continued success of any business depends on loyal customers. However, meeting their expectations is becoming more difficult as services are commoditized and disintermediated. Now, many platforms eliminate the need to reach out to banks—services are widely available from any device, anywhere. Apps are more complex but still user-friendly, making them convenient to a wider range of people. Customers demand to have immediate access to information and services directly from their personal devices and, if your business doesn’t keep up, they may turn to your competitors.

Customers’ needs and wants will continue to evolve and, if they want to keep up, financial organizations must dedicate themselves to understanding their customers on an intuitive level. To achieve this and deliver high-quality services, it is a must to embrace cutting-edge technologies.

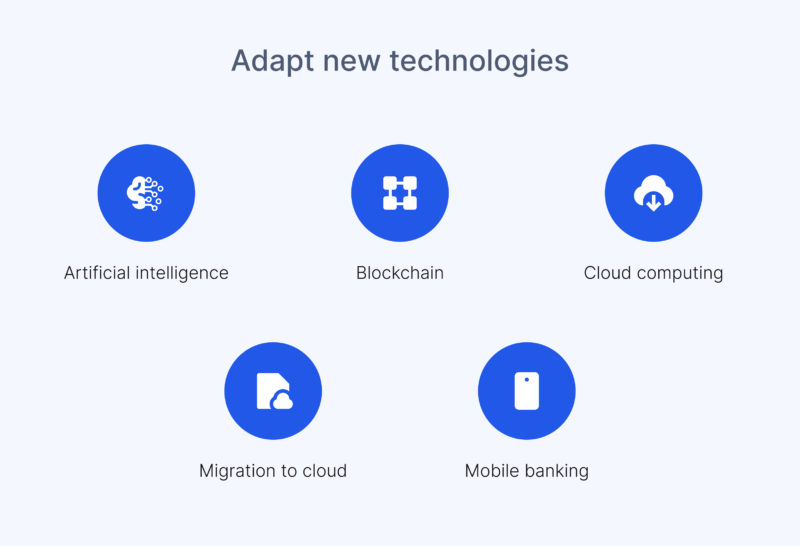

The integration of technological advancements in the financial industry is critical to the success of institutions in a human-centric economy, expanding the possibilities of the organizations that adapt. Following are some indispensable technologies being leveraged in the financial industry today.

AI is used by financial organizations to automate customer service, detect fraud, and score creditworthiness. By leveraging AI, FinTech companies can provide more personalized and efficient services to their customers. For example, AI-enabled DPFAs (Digital Personal Financial Assistant) already help customers by understanding and answering questions and performing complex tasks. They can identify the best financial product deals and prices, highlight costs and implications associated with financial transactions, and so on.

Through data analytics from multiple bank or non-bank sources and AI, DPFAs gain deep insights into customer behavior and financial habits. Comparing these indicators to all available products and services, the digital assistants can nudge users toward “better” financial outcomes and proactively guide them toward better decisions related to their financial well-being.

Blockchain is a decentralized digital ledger that allows for secure and transparent transactions. It is drastically transforming the financial services industry, where it is being used to enable digital identity verification, smart contracts, and secure and transparent transactions. Blockchain enables peer-to-peer payments and eliminates the need for intermediaries. It offers fast, transparent, and efficient accounting and storing of financial procedures and simplified interaction between partners. With Blockchain, customers will be able to seamlessly and quickly exchange value and make transactions in a secure way.

Cloud computing enables the storage and financial analysis of data in the cloud. Financial institutions are leveraging the cloud to build agile IT infrastructures, scale their businesses, reduce costs, reach faster processing speeds, increase security, and achieve compliance with regulatory requirements. One key advantage of cloud technology in the financial sector is the ability to access services anytime, anywhere, improving customer experience.

Financial services providers have begun migrating their IT infrastructure to the cloud to achieve more flexibility, scalability, and cost efficiency. Gartner predicts that cloud migration will continue to be a top priority for financial services companies in the coming years. In the future of the financial industry, the workloads deployed in the cloud will be not just popular but ubiquitous, while anything non-cloud will be seen as legacy.

Mobile banking enables customers to access their banking services on their mobile devices anytime from anywhere. They can view account information, make transactions, manage investments, receive support services, and stay up to date on financial news and the institution’s latest offerings.

Leveraging finance mobile apps to make payments or receive funds benefits both customers and business owners—customers save time while financial organizations cut down on operational costs. Ease of use for customers directly increases the volume of transactions, ultimately boosting business growth.

The marketplace of the future of digital finance will be fluid and interdependent. Innovative business models and alliances among financial institutions will help respond to these changes and create new revenue streams.

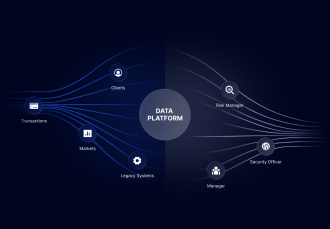

According to Deloitte, banks and companies that have already started to create ecosystems and alliances will have a significant advantage. Analysts foresee the emergence of consolidated “one-stop shop” platforms for offering and accessing various financial products and services, from loans to home mortgages, insurance coverage, retirement plans, and investment vehicles. These platforms will act as a central nervous system, coordinating dataflows, establishing common rules to manage productive interactions, and allowing owners of other platforms to consolidate around a single access point.

With the evolution of technology, the quantity and quality of data sources are becoming critical components. The accelerated datafication of the economy is making data one of the most powerful drivers of value creation, but this digitalization has a flip side—the increasing amount of data makes it an attractive target for cybercriminals. Thus, it is imperative to ensure that data never falls in the wrong hands.

Usually, established players in the financial market have massive security budgets to protect their customers’ data, but new entrants may find this difficult. Leaked customer data leads to the loss of reputation, and therefore, customers, money, and even business.

To strengthen customers’ rights in terms of data privacy, there are rules and regulations that every business must adhere to.

Complying with regulations may seem a pain, as it requires both extra effort and extra expenses. But regulations exist for a reason—aside from helping you avoid penalties, regulatory compliance makes financial apps safer. This strengthens trust with users, leading to a better user experience and, eventually, improving the success of the app.

Regulations will continue to play an influential role in shaping the financial services industry and the ability to embrace new technologies. Although regulations may lag behind innovations and societal expectations, policymakers are aware of the need to provide customers with broad access to financial services and are increasingly receptive to advancements that spur competition and prioritize data privacy and security. We can expect that legislators will regulate some innovations, such as open banking and cybersecurity, and will give more control over personal data to protect the customers.

Dealing with regulations may sound challenging, it can be made much easier with some help. Try teaming up with a company that has a wealth of experience in regulatory compliance and you will see that it is not as daunting as it seems.

It’s impossible to know what the future of financial services is, but now is the time to prepare for what lies ahead. Financial services companies should take a client-centric approach to retain existing customers and attract new ones. It is also imperative to begin adopting cutting edge-technologies to deliver enhanced, real-time customer experiences. Modernizing operating models and legacy systems is also a key step for financial institutions that want to keep up. For many businesses, especially new entrants, this may be hard to achieve, but until institutions upgrade their infrastructure, they won’t be able to compete with more responsive and innovative competitors.

Are you ready for tomorrow? Contact us to learn more about how you can step into the future of financial services.

Our team would love to hear from you.

Fill out the form, and we’ve got you covered.

What happens next?

San Diego, California

4445 Eastgate Mall, Suite 200

92121, 1-800-288-9659

San Francisco, California

50 California St #1500

94111, 1-800-288-9659

Pittsburgh, Pennsylvania

One Oxford Centre, 500 Grant St Suite 2900

15219, 1-800-288-9659

Durham, North Carolina

RTP Meridian, 2530 Meridian Pkwy Suite 300

27713, 1-800-288-9659

San Jose, Costa Rica

C. 118B, Trejos Montealegre

10203, 1-800-288-9659