Contact us

Our team would love to hear from you.

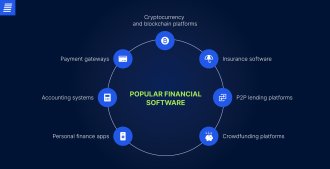

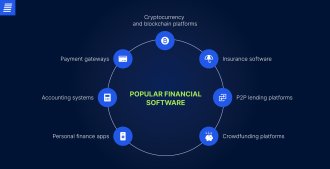

With such a big prize at stake, a lot of companies are in search for an optimal solution for business optimization. In this article, we will describe some game-changing financial software.

A growing business generates complex financial data and creates a demand for a scalable accounting system. Without accounting systems, such tasks as invoices processing, payment collection, payroll calculation, and reporting will take much time and will be more labour-intensive and error-prone. To deal with these problems, businesses use, for instance, such turnkey accounting systems as QuickBooks Online or turn to software development companies for a custom solution.

An accounting system is an essential tool for your financial data. Such software offers features to optimize business—from billing and invoicing to tax calculation to project management. It will also assist in:

According to Gartner, the most popular accounting software includes Xero, Oracle NetSuite ERP, Sage Intacct, and CCH Axcess.

Payment gateways act as a secure intermediary between bank accounts of the merchant and the customer. Gateways perform a number of functions, such as checking details of credit cards and verifying funds sufficiency. Synch systems also provide an intermediary account to simplify data exchange between banks—especially for international or small banks that have no direct or simple routing for faster money transfer. The transition to online businesses due to the COVID-19 pandemic has become the main factor that has helped the payment gateways technology prosper. PayPal, Stripe, Authorize.net, Amazon Pay, and Square are the examples of the most frequently-used payment gateways.

There are different types of payment gateway software:

Platform-based gateways. The ordering and payment processes are done through the merchant’s servers.

Hosted gateways. It is an alternative to platform-based gateways. Payments processing is done on someone else’s server—the customer is redirected to another website to complete payment.

Local bank integration systems. Customers are directed to the bank website to fill in payment details. After the payment is completed, they are redirected back to the merchant’s website.

Among the top benefits of this software we can mention:

The personal finance apps market is expected to reach $4.2 billion by 2032, thus becoming an additional factor in luring companies to work in this domain. According to Forbes, the most popular budgeting apps today are Quicken Simplifi, You Need A Budget (YNAB), and CountAbout.

Personal finance applications help not only keep track of incomes and expenses, but also analyze them. Such fintech applications may connect to bank accounts and help you see your spending trends. In addition, they help you find out your major spending category, monitor upcoming bill payments (some allow you to pay bills directly via the app), and keep an eye on credit scores and investment portfolio. The best personal finance apps also provide such features as bill due dates, subscription tracking, e-mail reminders, shared wallets, etc.

In terms of functionality, personal finance apps possess the following features:

Peer-to-peer (P2P) lending platforms offer a relatively new way to lend and borrow money. Borrowers and investors do not have to deal with traditional financial institutions, which is most beneficial especially in the field of small consumer loans.

A P2P platform is an intermediary that sets the rules for participants. The main advantage of using a P2P lending platform is its simplicity for users. Both parties do not need to meet in the office and wait for the processing of documents—everything happens online. Unlike banks, such solutions also reduce transaction costs and offer more attractive conditions for investors.

This platform provides technical support and electronic document management on the site and monitors the timeliness of payments. It is engaged in checking borrowers and preparing documents for the transaction. Some systems may also control borrowers and help them get back on schedule in case of delays. LendingClub, Upstart, Prosper, Peerform, and Honeycomb Credit are among the leading P2P platforms today.

The pandemic has significantly accelerated the development of some areas of InsurTech. The lockdown has created a habit among consumers that everything can be done online, including insurance. Insurance software solutions help people insure property and casualty (BriteCore), health (AgencySmart), cars (Lemonade, Inc.) as well as allow insurers and their clients to fulfill other affiliated tasks, such as document management, billing and invoicing, task management, and commission tracking.

There are a lot of popular crowdfunding platforms such as Kickstarter or Patreon that help raise money for various projects. But few people know how these platforms monetize. They keep on average about five percent of the funds raised as a reward for intermediary services. Such huge profits explain the increased demand for the development of crowdfunding platforms.

To develop a crowdfunding platform which earns, it is vital to start with:

Based on the above points, the design and functionality of the crowdfunding platform is determined.

Blockchain appeared relatively recently, in the year 2008, so we are still learning how to make the most of its capabilities. Blockchain helps in data protection, personal identification, company verification, transaction registration, investments, risk management, contract signing, etc. This broad scope of application stems from the safety and reliability of the technology; therefore we can expect the same diversified blockchain development in the future. Other benefits of the blockchain technology are:

The most relevant blockchain area for FinTech is cryptocurrency. Bitcoin value is growing, and other cryptocurrencies are trying to keep up with it. The demand for them is increasing, so the possibility of working with these currencies is important for banking applications.

EffectiveSoft’s client is a UAE fintech organization that delivers a buy-now-pay-later (BNPL) platform for installment payments. To offer its services in various regions, the company used two payment gateways.

After deciding to expand to a new market, the client faced an issue—the existing payment systems did not function there, fueling the need to integrate the BNPL platform with another payment provider. As the client’s in-house development team lacked the required resources to ensure back-end implementation of a new payment flow, the fintech company approached EffectiveSoft. Its request was to develop and integrate a new payment provider into the existing platform, receiving comprehensive post-launch support afterward.

Our team employed the COPYandPAY flow to integrate a Hyperpay payment gateway into the BNPL platform. To ensure a seamless process, we used the Server-to-Server (S2S) solution that allowed for processing financial transactions without Hyperpay’s widgets. This way, payment requests were directed to the specific payment channel using the customer’s card BIN code.

An S2S approach allowed us to implement the necessary security measures like card data tokenization (responding from the Hyperpay server) and card authentication (using standalone 3D secure 2.0), making all financial transactions safe and secure.

We skillfully integrated the payment gateway into the BNPL platform and provided tailored support, empowering the client to reach a new market and grow their business.

Our client is a fintech organization that needed a P2P lending platform to connect individual private investors and borrowers, excluding financial intermediaries and legal entities. The platform had to be an easy-to-use web app that would plan and manage finance like investments and borrowings. Additionally, it had to provide more opportunities to investors due to higher interest rates and no additional charges. The client turned to EffectiveSoft to transform their vision into reality.

To create the web app, our developers used HTML5 and JQuery for the frontend and the LAMP tech stack with CodeIgniter and CI Validation for the backend. To establish communication between the client side and server side, we employed JSON. We also equipped the P2P lending platform with a wide range of features that helped:

The EffectiveSoft team delivered a full-scale P2P lending platform to the client. The web app provides an excellent user experience (UX) for lenders and borrowers, allowing them to directly engage in the necessary transactions without involving traditional financial parties.

Our client is a coalition of international charitable foundations that faced significant challenges because of conventional fundraising methods. These methods incurred high transaction fees, lacked transparency, had limited geographical reach, and inhibited fund transfer processes. To address these issues, the client decided to build a decentralized finance (DeFi) app, entrusting EffectiveSoft with the mission.

Our team developed a full-fledged DeFi solution based on blockchain and its elements like smart contracts and a staking system. We added several essential layers to smart contracts—including a donation contract, staking contract, and multi-signature contract—to effectively manage the app’s logic. To anticipate and resolve potential performance issues, we also implemented the server-side logic that replicates read requests for non-fungible tokens (NFTs). This ensured quicker data sorting and retrieval and optimized the app’s performance.

Additionally, we created a navigable front-end component, enabling users to easily make donations and gauge the progress of their fundraising campaigns. Finally, we designed a staking system based on Aave’s lending protocol, which allowed users to complete operations related to donations, staking, interest accrual, and fund withdrawals.

EffectiveSoft delivered a powerful crowdfunding app that helped the client confront existing challenges and raise money efficiently, increasing transparency and attracting more donors worldwide.

EffectiveSoft’s client is Dragon Infosec Ltd., which specializes in artificial intelligence (AI), cybersecurity, and blockchain. The company nurtured the idea of creating its own cryptocurrency by re-engineering its existing Temporal Blockchain platform and chose EffectiveSoft as a partner to realize this goal.

By following the client’s requirements, our specialists overhauled the Temporal Blockchain platform and used it as a building block for the new Temtum (TEM) cryptocurrency. We created the Temtum API to help users complete online transactions and developed the Temtum Wallet—available on iOS and Android devices—to transfer the cryptocurrency. The system we created is distinguished by high transaction throughput speed, low resource consumption, decentralized scalability, and improved security.

EffectiveSoft successfully delivered the project, bringing the client’s idea of creating a competitive cryptocurrency to life. By re-engineering the Temporal Blockchain platform, we developed a decentralized cryptocurrency payment system with comprehensive security, improved scalability, and lightning-fast speed.

Forty seven percent of traditional financial companies are considering taking up FinTech in the near future. Undoubtedly, the evolution of FinTech will result in people’s financial literacy. Financial technologies will also help businesses thrive by giving them the tools to manage their funds effectively. Already have an idea of financial software development? Drop us a line, and we will help you translate your idea into an advanced solution.

Yes, financial solutions integrate with various business systems. They encompass enterprise resource planning (ERP), customer relationship management (CRM), human resource management (HRM) software, and more.

The most popular types of financial solutions include but are not limited to personal finance apps, accounting systems, payment gateways, P2P lending platforms, insurance software, crowdfunding platforms, and cryptocurrency and blockchain solutions.

EffectiveSoft, as an experienced financial software development company, prioritizes the following features during financial software development: scalability, security and compliance, user-friendliness and usability, integration capabilities, compatibility with existing systems, and many others.

If you are looking for a one-stop and reliable financial software development partner, EffectiveSoft is the perfect fit for several reasons. We have been at the forefront of fintech software development for over 21 years, during which time we have successfully delivered projects to Dragon Infosec, CityIndex, BullionRock, and other companies. Our high-profile specialists actively engage in every stage of the financial software development process—from planning to maintenance—ensuring your project is delivered on time and within the estimated budget. By taking a transparent Agile approach, we keep our clients informed about a project’s status, necessary changes, achieved milestones, and other essential aspects. Finally, our steadfast focus on security and compliance endorsed by the ISO/IEC 27001 certification guarantees the financial software we deliver is tamper-proof, resilient, and high-performing around-the-clock.

Can’t find the answer you are looking for?

Contact us and we will get in touch with you shortly.

Our team would love to hear from you.

Fill out the form, and we’ve got you covered.

What happens next?

San Diego, California

4445 Eastgate Mall, Suite 200

92121, 1-800-288-9659

San Francisco, California

50 California St #1500

94111, 1-800-288-9659

Pittsburgh, Pennsylvania

One Oxford Centre, 500 Grant St Suite 2900

15219, 1-800-288-9659

Durham, North Carolina

RTP Meridian, 2530 Meridian Pkwy Suite 300

27713, 1-800-288-9659

San Jose, Costa Rica

C. 118B, Trejos Montealegre

10203, 1-800-288-9659