Contact us

Our team would love to hear from you.

Financial platforms operate in environments that leave no margin for error. External services, regulatory compliance, and high-volume operations all must stay in sync. Even one little detail falling out of alignment can affect the performance and reliability of the entire system.

Maintaining this coordination requires ongoing system monitoring and refinement. Our IT support for finance is designed to address this exact need.

Services

If defects, system errors, and production issues occur, we trace them to the failure point, assess how they affect the system, and fix the code or settings that caused the incident, restoring the system to a stable, predictable state.

We continuously track performance, availability, security, and overall system health in real time. Any irregularity triggers an alert, allowing us to quickly analyze and address the issue before it affects system stability and user experience.

EffectiveSoft’s engineers execute remediation actions to address discovered vulnerabilities, maintaining overall system protection and avoiding interruptions to critical financial processes.

Our team oversees cloud and on-premises infrastructure, deployments, backup and disaster-recovery procedures, and runtime configurations to ensure that environments are consistent, updates are deployed cleanly, and backup and recovery mechanisms are ready to run when required.

By fine-tuning app logic, databases, queries, and infrastructure, we ensure that every part of the platform operates at maximum efficiency. Our targeted improvements boost the system’s speed, reliability, and scalability, allowing financial organizations to support high transaction volumes and deliver a consistently responsive user experience.

We incorporate AI-driven monitoring tools that detect irregular patterns and suspicious activity before they affect critical processes. When required, we also introduce AI-supported automation and LLM-based assistants to enhance daily operations.

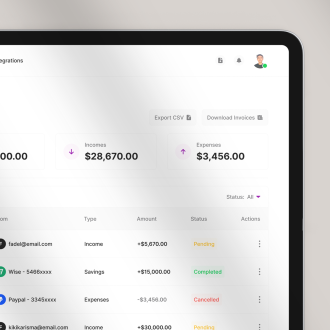

Financial platforms rely on numerous external services that are constantly evolving. Even a minor change in an API, if undetected, puts the system at risk. To prevent this, we maintain integrations with payment providers, banking APIs, KYC/AML tools, external data services, and other third-party platforms to ensure stable communication and uninterrupted financial transactions.

Legacy systems often struggle with outdated architectures, technologies, and integration, hindering business initiatives, slowing innovation, and complicating compliance with regulations and market changes. For companies not yet ready to abandon long-standing, proven systems, we offer stabilization, refactoring, and gradual improvement of existing platforms to extend the software’s lifespan or prepare it for modernization.

Even well-designed financial platforms require ongoing refinements to support evolving user demands. Minor inefficiencies in functionality or outdated interface elements impact the overall experience. We address these challenges with small-scale usability refinements, interface updates, and functional adjustments based on user or business feedback.

Solutions

Financial software comes in many forms—from online banking to complex trading engines—each demanding an individual approach to maintenance and support. Below are the types of fintech solutions we maintain and support.

Online and mobile banking systems and customer portals that require uninterrupted availability, strong protection of sensitive user data, and a consistent user experience.

Card payment gateways, POS integrations, and payment orchestration engines, where stability and seamless communication with third-party providers are essential.

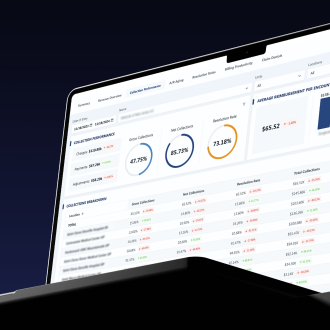

Brokerage systems, portfolio management solutions, and algorithmic trading tools that depend on low latency, accurate data, and high-quality performance.

Financial planning systems and automated investment advisory engines that require enhanced security for personal financial data and precise calculation logic.

Software for loan origination, servicing, and credit scoring, where reliable performance impacts operational efficiency and revenue.

Policy management, claims processing, underwriting automation, and risk assessment, where data accuracy and timely processing are crucial.

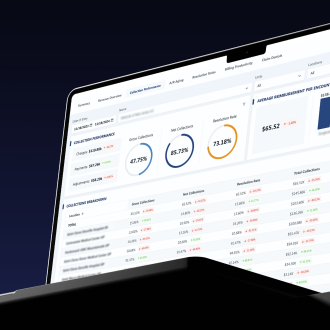

BI dashboards, regulatory reporting systems, and custom analytics platforms that provide accurate, timely insights for informed decision-making.

Automated billing engines, recurring payment systems, and financial document management software that require accurate high-volume, error-free data processing.

Cryptocurrency exchanges, wallet apps, blockchain-based payment systems, and DeFi integrations where rigorous security and cohesive connectivity ensure reliable transactions.

“In highly regulated industries like finance, security is nonnegotiable. It influences the entire business, its income, future, and customer loyalty. A single bug or vulnerability can undermine years of work and cost billions of dollars. The only effective way to mitigate that risk is to stay ahead of it. That’s what our maintenance and support services are designed for—to keep your platform secure, stable, and ahead of emerging threats.”

Delivery Manager

Benefits

Here’s what you’ll gain with our maintenance and support services for financial platforms.

Your financial platform stays available whenever it is needed: no unexpected service interruptions that slow down operations and frustrate users.

Pages load quickly, transactions process without delays, and the platform maintains steady performance.

Ongoing maintenance and support keep the platform sound and adaptable, allowing the system to scale along with your business.

With systems running smoothly, your team can focus on driving the business forward instead of troubleshooting issues.

Threats are detected and addressed before they reach your customers and cost you money.

Regulatory compliance is no longer a source of stress thanks to continuous checks to keep the system aligned with current requirements.

EffectiveSoft ensures consistent performance and security for a multiplatform trading app with around-the-clock maintenance and support services.

We replaced outdated infrastructure to improve efficiency and reduce operational costs.

The implementation of the chatbot reduced the company’s service costs and significantly enhanced customer service.

Want more?

View portfolioWhy us

Since 2003, we have helped hundreds of banks, payment providers, traders, and fintech startups build, scale, and maintain their mission-critical financial platforms. This long-standing experience enables us to anticipate challenges and apply proven practices to ensure your system remains reliable.

Our portfolio includes developing, refining, and supporting banking systems, trading apps, digital wallets, insurance software, payment engines, and beyond. All our solutions are built using a modern tech stack, meet the latest security and compliance standards, and operate reliably under high loads.

EffectiveSoft engineers have certifications from Amazon, Microsoft, and Oracle and expertise in security, DevOps, quality assurance (QA), and solution architecture. For your business, this means reduced risks, high delivery quality, and the confidence that comes from dealing with qualified professionals.

PCI DSS, PSD2, ISO 27001, SOC 2, AML/KYC requirements, GDPR, SOX, and other region-specific standards form the foundation that shapes our engineering decisions. Our maintenance and support services for financial platforms ensure that your system aligns with compliance and market expectations.

We prioritize security and embed it in every stage of our process. We verify every interaction within the system, implement secure coding practices, conduct regular vulnerability scanning, and promote continuous learning to ensure the high-quality services your platform deserves.

Transparency, open communication, and mutual trust are the core pillars that sustain lasting partnerships, and we make these principles a daily practice. As a result, businesses around the world entrust us with their critical long-term projects, and 60% of them return to us with new initiatives.

Are you seeking a trusted company providing IT support financial services? EffectiveSoft is ready to help.

Service models

If your system must work 24/7 and every minute counts, this model ensures that an expert monitors your platform day and night, instantly reacting to any issue.

A service-level agreement (SLA) defines strict response times and the scope of responsibilities we commit to when providing maintenance and support services.

If you already have specialists in place and need extra hands or expertise, this model fits you well. Our engineer becomes an integral part of your team.

You get a fully-staffed team that dives deep into your project as if they were part of your organization.

If you are not sure your system requires constant support, you can call us when you need a specific task done.

Financial platforms operate with large volumes of sensitive information, strict regulatory compliance, and evolving customer expectations. This makes maintenance, support, and data protection financial services essential for these systems.

We work with banks, traders, payment gateway providers, insurance companies, and other businesses that strive to maintain the highest quality standards for their fintech platforms.

We align our IT support services for financial companies with global, regional, and banking compliance requirements from day one. This includes maintaining meticulous documentation and conducting proactive, regular compliance checks.

Yes, we can take over support from another vendor or in-house team without interrupting your operations. We coordinate with your previous vendor or internal specialists and analyze existing documentation to understand workflows, known issues, and system specifics.

We start with an onboarding process that includes an initial system audit. At this stage, we review your architecture, codebase, integrations, and dependencies, and examine existing documentation. Then, we perform risk and gap assessments, define priorities, and prepare a support plan.

Usually, critical issues receive immediate or near-immediate attention, while lower-priority tasks follow timelines defined in an SLA agreement we sign with our clients.

Yes, we maintain, update, and troubleshoot integrations with third-party systems like banking APIs, payment gateways, trading data providers, and other fintech systems.

We use secure coding practices, regular monitoring, testing, and access controls to keep security clients’ systems secure during maintenance and support services.

Yes, we provide hybrid, on-premises, and cloud support for financial services. If needed, we plan and perform secure cloud-to-cloud and on-premises-to-cloud migrations.

Can’t find the answer you are looking for?

Contact us and we will get in touch with you shortly.

Our team would love to hear from you.

Fill out the form, and we’ve got you covered.

What happens next?

San Diego, California

4445 Eastgate Mall, Suite 200

92121, 1-800-288-9659

San Francisco, California

50 California St #1500

94111, 1-800-288-9659

Pittsburgh, Pennsylvania

One Oxford Centre, 500 Grant St Suite 2900

15219, 1-800-288-9659

Durham, North Carolina

RTP Meridian, 2530 Meridian Pkwy Suite 300

27713, 1-800-288-9659

San Jose, Costa Rica

C. 118B, Trejos Montealegre

10203, 1-800-288-9659