Contact us

Our team would love to hear from you.

Managing healthcare claims continues to be one of the most intricate and expensive administrative functions. In the U.S. alone, providers collectively spent over $25.7 billion on claim adjudication in 2023. This was a 23 % increase over the previous year with denial rates hovering around 15%. Meanwhile, administrative overhead accounts for about 25% of total U.S. healthcare spending, which is roughly double the rate seen in other developed countries.

These figures reflect more than just financial strain—they highlight deep-seated inefficiencies. Manual workflows, data inaccuracies, outdated coding, and time-consuming denial management in medical billing all contribute to delayed reimbursements, stale cash flow, and frustrated staff and patients.

This difficult reality creates an opportunity for AI. AI offers a way to overhaul claim operations through intelligent document processing, automated coding, and fraud detection. Leveraging AI speeds up processing. It also increases first-pass acceptance rates. It tightens compliance. It cracks down on fraud. And it improves transparency for patients. The result is a smarter, more reliable claims ecosystem for payers, providers, and patients.

Let’s map the modern claim management workflow:

Despite being labeled “modern” and driven by digital tools, this process is still riddled with friction:

To put this into perspective: nearly $25 billion is spent each year on claim processing inefficiencies. In 2024, about 11.8% of claims faced initial denials, up from 11.5% in 2023.

This blend of human error, outdated workflows, system complexity, and increasing compliance demands makes claim management workflow not only one of the most vulnerable and costly administrative functions but also the most urgent target for intelligent transformation.

Historically, healthcare claim management relied on a patchwork of manual reviews, static business rules, and disjointed systems. AI is fundamentally changing this outdated routine. From data capture to denial resolution, AI tools are not only streamlining processes but also making them smarter, faster, and significantly more reliable. Below, we break down where these capabilities are making the biggest impact.

Claim management begins with a lot of paperwork. AI-powered optical character recognition (OCR), combined with natural language processing (NLP), now allows systems to automatically extract relevant information from scanned medical records, electronic health record (EHR) notes, insurance forms, and explanation of benefits (EOB) documents. IDP accelerates claim initiation and improves data accuracy, eliminating manual data entry and reducing transcription errors. Providers have reported noticeable reductions in claim preparation time, with some experiencing processing speeds that are 60%–70% faster than manual workflows.

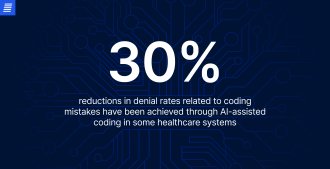

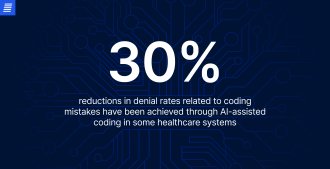

One of the most prevalent and costly factors behind claim denials is coding errors. AI-driven coding assistants analyze clinical documentation in real time, suggesting appropriate ICD-10, CPT, and DRG codes based on the content of physician notes, diagnostic reports, and operative summaries. These tools reduce the burden on human coders and minimize miscoding incidents, leading to higher first-pass acceptance rates and lower rework volumes. In some healthcare systems, AI-assisted coding has cut denial rates related to coding mistakes by nearly 30%.

Before a claim is even submitted, AI-powered predictive models help providers understand how it is likely to be received. Trained on historical claims data, these algorithms can forecast approval probability, expected processing times, and denial likelihood with remarkable accuracy. By flagging high-risk claims early, providers can correct documentation errors, validate codes, or gather missing information to address potential problems in advance. For instance, if a high-value procedure such as a major orthopedic surgery shows a strong likelihood of denial based on historical data, staff can proactively ensure that preauthorization and all necessary documents are completed before submission.

Even with proactive measures in place, claim denials remain a stubborn and costly part of the revenue cycle management (RCM) process. AI is changing the approach organizations respond from manual rework to targeted, data-driven action. A key strength here is automated root-cause analysis: as soon as a claim is denied, AI pinpoints the underlying issue, whether it’s documentation gaps, coding mismatches, or eligibility errors, and suggests specific corrective actions. More advanced models also predict the likelihood of a successful appeal, allowing teams to prioritize high-value, recoverable denials and avoid chasing low-probability cases.

The claims process doesn’t end with adjudication. Providers and patients often need updates, explanations, or assistance in resolving disputes. AI enhances this post-claim experience with conversational tools like chatbots and voice assistants, as well as backend systems that provide real-time claim status alerts, document requests, and explanation of benefits (EOB) support. For providers, this means faster access to the information they need and fewer administrative bottlenecks. For patients, AI handles frequent coverage and billing questions. This reduces the burden on call centers and improves transparency.

Omega Healthcare, a leading medical revenue cycle management provider with over 30,000 employees and nearly 250 million annual transactions, needed a more scalable solution to handle growing volumes of clinical documentation. To address this, the company adopted UiPath’s AI-driven Document Understanding platform, featuring OCR and NLP to extract and organize data from disparate healthcare documents. Here are the key outcomes:

A top-tier U.S. insurer serving over 3 million members integrated Appian’s low-code platform with AI technologies provided by Brillio to modernize its claim adjudication process. Prior systems were hindered by fragmented workflows and time-consuming manual reviews. The solution combined OCR, intelligent form processing, sentiment analysis, and machine learning (ML) models to triage and prioritize claims based on predicted outcomes. Here’s what they achieved:

In an effort to combat rising fraud and waste, Personify Health partnered with Health at Scale, the Massachusetts Institute of Technology (MIT), and the University of Michigan to deploy an advanced, real-time claims screening platform. The system was designed to detect irregular billing patterns and provider behavior. It could analyze vast datasets across regions, services, and time frames with high precision, flagging problematic claims before payment. The results are as follows:

We developed a management system for enhanced medical billing and insurance claim submission and processing.

AI is already changing claim management, and the next wave of innovations promises to further integrate these technologies into healthcare operations. Here are the key trends on the horizon.

As the healthcare system shifts away from fee-for-service toward value-based reimbursement models, AI will play a key role in aligning claims data with clinical outcomes and contract terms. You can expect to see AI-driven adjudication tools that factor in quality metrics, risk scores, and bundled payment conditions, ensuring claims reflect not just services rendered, but value delivered.

Training healthcare AI models is heavily constrained by data privacy concerns. Federated learning, where AI models are trained across decentralized data sources without exchanging sensitive patient information, is gaining traction. This approach enables payers, providers, and AI vendors to collaborate on powerful, accurate claim management tools while maintaining HIPAA (or GDPR) compliance.

Instead of reacting to denials and payment delays, future RCM strategies will leverage AI to proactively flag potential claim issues before submission. These systems will assess claim completeness, coding accuracy, and payer-specific risks in real time, increasing initial acceptance rates and reducing downstream financial headaches.

Contract negotiation between payers and providers has traditionally been a complex, manual process. AI is poised to change this space for good, with tools that can analyze historical claims data, forecast the financial impact of proposed contract terms, and identify negotiation opportunities, giving healthcare organizations more control over reimbursement rates and operational risk exposure.

Today, it’s clear that AI is no longer a fringe experiment in healthcare claim management but a proven tool delivering a real operational advantage. From reducing processing times and denials to catching fraud to improving billing transparency, AI provides tangible results at every stage of the revenue cycle.

For health systems and insurers facing rising costs, staffing shortages, and intensifying patient expectations, adopting AI-driven solutions isn’t optional—it’s essential for operational stability and competitive relevance. The organizations leading this charge aren’t just optimizing claims—they are helping build a healthcare system that is smarter, faster, and fairer.

Ready to bring AI into your claims process? Contact our team to start building the right solution for your organization.

AI in claim management involves using AI technologies like ML and NLP to automate and improve the efficiency and accuracy of claim processing.

Some of the key benefits of implementing AI in RCM include streamlined claim processing, improved accuracy, reduced costs, better decision-making, and enhanced customer experience. AI can also help detect and prevent fraud through pattern recognition and real-time alerts.

Healthcare systems like RCM handle a vast amount of sensitive data, referred to as protected health information (PHI), which should remain protected and secure. When implementing AI-powered RCM, companies should follow industry standards, regulations, and best practices for encryption, secure data storage, strict access controls, data anonymization, continuous monitoring and auditing, and compliance frameworks.

While AI has the potential to significantly improve claim processing, it also comes with risks and limitations, including potential bias or inaccuracies stemming from training data, lack of transparency, regulatory and compliance concerns, and difficulties integrating AI with legacy systems.

Can’t find the answer you are looking for?

Contact us and we will get in touch with you shortly.

Our team would love to hear from you.

Fill out the form, and we’ve got you covered.

What happens next?

San Diego, California

4445 Eastgate Mall, Suite 200

92121, 1-800-288-9659

San Francisco, California

50 California St #1500

94111, 1-800-288-9659

Pittsburgh, Pennsylvania

One Oxford Centre, 500 Grant St Suite 2900

15219, 1-800-288-9659

Durham, North Carolina

RTP Meridian, 2530 Meridian Pkwy Suite 300

27713, 1-800-288-9659

San Jose, Costa Rica

C. 118B, Trejos Montealegre

10203, 1-800-288-9659