Contact us

Our team would love to hear from you.

Rapid digitization is transforming every aspect of our lives, and trading is no exception. Trading applications are becoming increasingly sophisticated, bringing the financial markets directly to traders’ fingertips. These solutions enable users to react in real time, capitalizing on market trends and making informed trading decisions anywhere, anytime. As the demand for advanced trading applications grows, so does the need for developers to understand the trends driving the market and incorporate them into their products. From seamless user experience to advanced analytics or risk management, the selection of trading app features and technical platforms can make or break the solution’s success. In this article, we delve into the world of trading app development. We will cover how to select the best technical platform, essential features that every modern trading app must have, and advanced features that can give your app a competitive edge. Read on to learn more!

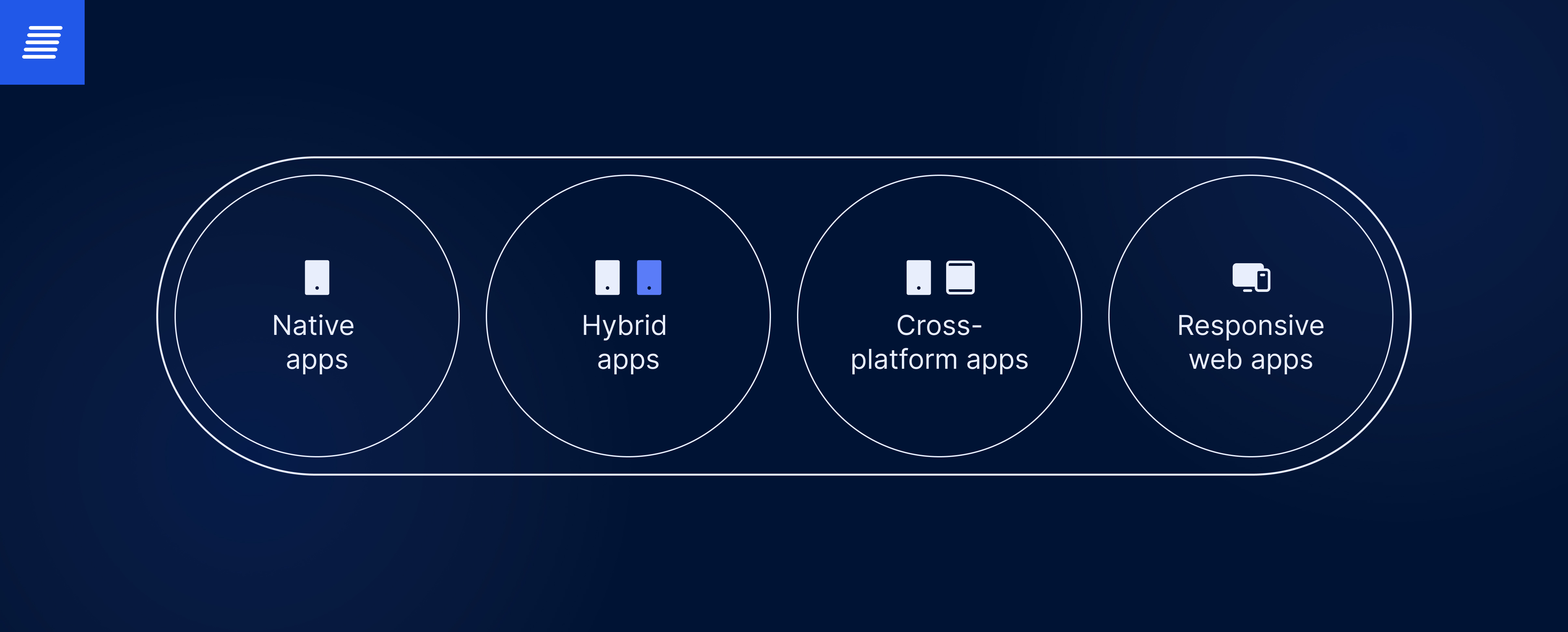

The first crucial decision in a new trading app project is choosing the technical platform. This choice will impact key quality indicators like performance, cross-device support, and development efficiency. Your options include native apps, hybrid apps, cross-platform apps, and responsive web apps. Each has strengths and weaknesses, which we will explore below.

Native apps are built separately for each mobile operating system, typically iOS and Android. They are unique in providing direct access to a device’s hardware and operating system. This is critical for performance-intensive applications such as high-frequency trading, where low latency and optimization are top-of-mind. Native Kotlin/Java on Android and Swift/Objective-C on iOS deliver excellent performance to fulfill the necessary requirements. For iOS-related tasks specifically, integration with Xcode IDE and interface builder enables accelerated development of high-performance user interface (UI) code. Additionally, tools such as Android’s Native Development Kit (NDK) and iOS’s Metal API provide gateways to low-level APIs and rendering engines, enabling enhanced graphics, better resource management, and ultimately, a more seamless user experience. Native solutions also offer faster access to emerging capabilities such as artificial intelligence (AI), machine learning (ML), and AI APIs.

Tradeoffs of this approach include the need for specialized knowledge and separate codebases for each operating system, which can lead to increased time and higher cost for development and updates. However, the performance optimizations offered by native compilers, such as Android’s Ahead-Of-Time compilation can help mitigate the additional performance demand.

We developed a desktop trading platform and a first-to-market live trading app for iOS and Android to help City Index users trade effectively, regardless of time and place.

Hybrid and cross-platform trading apps are attractive alternatives that address the challenges often encountered in native development.

Hybrid trading apps enclose web apps developed using common web technologies, such as HTML5, CSS3, and JavaScript, in a native shell customized for each platform. This allows accelerated development of the front-end UI and visualizations of trading data. While hybrid apps may not offer a fully native UX in terms of performance, their seamless data visualization and interactions are often sufficient for trading purposes. When fast development is paramount, a hybrid app may be the best option.

Cross-platform apps, developed using frameworks like React Native, Flutter, or Kotlin Multiplatform (KMP), offer a unified codebase that can be compiled for both iOS and Android. This results in significantly lower development and maintenance costs than building native iOS and Android apps separately. Cross-platform apps also enable responsive UIs across mobile devices required for visualizing changing market data in real time. The ability to reuse business logic modules further accelerates trading app development.

Another option to consider is responsive web trading apps. Responsive web apps are essentially websites built using responsive design techniques, enabling the same codebase to adjust layouts to various screen sizes, ranging from desktop to mobile. Ideal for simpler trading apps designed for casual traders, these solutions offer rapid development and minimal maintenance post-deployment. Although these solutions may have limited native device capabilities, their ability to quickly build and iterate on mobile-friendly interfaces for market data, news, and basic trading modules allows for quicker web app deployment compared to the cross-compilation or hybrid methods. Responsive sites function seamlessly across all devices and require minimal maintenance or redeployment once live. For trading startups seeking quick market entry, responsive web apps enable the creation of an app-like experience with no delays.

Following are some key factors to consider when choosing between hybrid, cross-platform, responsive, and native development for building a trading app.

If ultra-high performance, low latency, and a smooth UI are critical, native development may be the best choice. Hybrid development can also achieve good performance through efficient coding, offering a balance between performance and development efficiency. Responsive web apps might suffice for simpler trading apps.

Native development enables quicker access to the latest platform-specific features. Hybrid and cross-platform apps may have delays in adopting these features. Responsive web apps might lack some platform-specific functionalities.

Native apps require a larger initial investment but result in highly optimized apps customized for each platform. Hybrid and cross-platform apps typically entail lower costs per platform and in some cases expedit development due to their single codebase. However, they may necessitate duplicated efforts to ensure optimal performance across different platforms. Responsive web apps can be the most cost-effective, particularly for simpler trading apps.

When targeting multiple platforms, hybrid, cross-platform, and responsive web apps are typically faster to market than native apps because they use a single codebase. However, for single-platform apps, native app development time can potentially be faster.

The choice of development approach can depend on the target platform(s). When focusing on a single platform, native development may prove to be more efficient. For multiple platforms, hybrid or cross-platform development is often preferred due to the shared codebase. Responsive web apps work across all platforms and devices.

The proficiency of development teams in various languages and tools could serve as a guiding factor in making the appropriate choice. Native languages like Swift or Kotlin are well-suited for native development, while expertise in web technologies often lends itself to hybrid, cross-platform, or responsive web app development.

Maintenance needs differ depending on the selected platform. Native development necessitates maintenance of multiple codebases, while hybrid, cross-platform, and responsive web apps typically involve maintaining a single codebase.

For a highly customized platform-specific UX, native development is ideal. Hybrid and cross-platform apps can also provide a smooth and engaging UX, albeit with potential minor UX limitations. Responsive web apps may not offer a rich UX but can still provide users with an app-like feel.

The choice between native, hybrid, cross-platform, or responsive web app development depends on the app’s specific requirements, target platforms, timelines, budget, and the skills of your development team. Weighing these factors carefully will ensure your trading app effectively meets user needs and aligns with business goals.

Still struggling with selection? With a solid foundation built on numerous success stories in the trading domain, our specialists carefully analyze all possible options and offer you the one that precisely aligns with your demands and requirements.

We developed a trading platform that allows users to create their own rules to trigger alerts and automate orders.

Once the technical foundation has been selected, the next critical step is determining the core functionality that will drive trading workflows and enhance the trading experience.

Equipping traders with robust charting enables them to precisely access trading opportunities at a glance. To deliver a seamless experience, mobile charting should provide:

Timely alerts keep traders updated on opportunities without having to constantly check the mobile app:

Fast and efficient trade execution is crucial for capitalizing on identified opportunities. Mobile trading apps should focus on providing:

Enabling quick and easy deposits and withdrawals is key for a seamless mobile trading experience. For this purpose, mobile apps should aim to provide:

By integrating with leading payment solutions and keeping traders informed on deposit status, the overall funding experience is optimized to ensure seamless flows from funding to order execution.

Mobile apps enable traders to develop their knowledge and skills anytime from anywhere:

While robust functionality provides a solid foundation, leading trading apps continuously enhance capabilities to remain competitive. By integrating the latest innovations, developers empower app users to trade smarter and faster.

AI and ML are transforming trading apps by facilitating the analysis of massive datasets beyond human capabilities, uncovering patterns, trends and relationships within markets. This provides traders with predictive analytics dashboards and personalized recommendations to make faster and more precise decisions. Chatbots powered by natural language processing can provide customer support 24/7, answering trader queries instantly. Trading apps equipped with integrated AI-driven features offer users timely guidance, customized strategies, and streamlined assistance.

Blockchain technology, in conjunction with decentralized finance (DeFi), opens new possibilities. Apps can integrate major cryptocurrencies like Bitcoin, offering mobile-friendly access to blockchain assets for a comprehensive trading solution. Traders can explore both traditional and digital investment opportunities through a single solution, streamlining the investment process and expanding potential investments.

Social trading capabilities enable collaboration in the typically isolated activity of investing. Users can follow experienced traders within the app community and apply their strategies in real-time. Chat rooms and forums promote idea exchange and knowledge sharing between traders with various skill levels. At its core, social trading makes investing more accessible for beginners by allowing them to learn from the big guns. The social element also makes trading a more engaging and interactive experience.

Integration with Internet of Things (IoT) devices is a fast emerging trend in the trading app landscape. Wearable devices like smartwatches are increasingly being used to receive trading alerts and execute trades. These integrations significantly enhance convenience and flexibility by enabling traders to stay connected to markets and make trades on the go.

With the power of mobile apps, trading, which used to require the resources of Wall Street, is now available at your fingertips and at a moment’s notice. This unprecedented accessibility has significantly accelerated trading opportunities. The key to maximizing this potential lies in providing traders with a mobile trading experience that is both robust and optimized, catering specifically to their needs. If you’re ready to create a trading app that combines speed, efficiency, and advanced capabilities, contact EffectiveSoft. Let us help you transform your concept into a powerful tool that sets new standards in mobile trading.

Our team would love to hear from you.

Fill out the form, and we’ve got you covered.

What happens next?

San Diego, California

4445 Eastgate Mall, Suite 200

92121, 1-800-288-9659

San Francisco, California

50 California St #1500

94111, 1-800-288-9659

Pittsburgh, Pennsylvania

One Oxford Centre, 500 Grant St Suite 2900

15219, 1-800-288-9659

Durham, North Carolina

RTP Meridian, 2530 Meridian Pkwy Suite 300

27713, 1-800-288-9659

San Jose, Costa Rica

C. 118B, Trejos Montealegre

10203, 1-800-288-9659